Introduction

The financial services sector in Uganda involves the businesses and institutions that manage money and provide intermediary services to transfer and allocate financial capital in an economy. The financial services sector is a service industry and it supports and supplements all other in- dustries but does not (itself) result in an end product such as goods. The financial services sector is a key sector and creates the fabric & framework on which all other sectors stand.

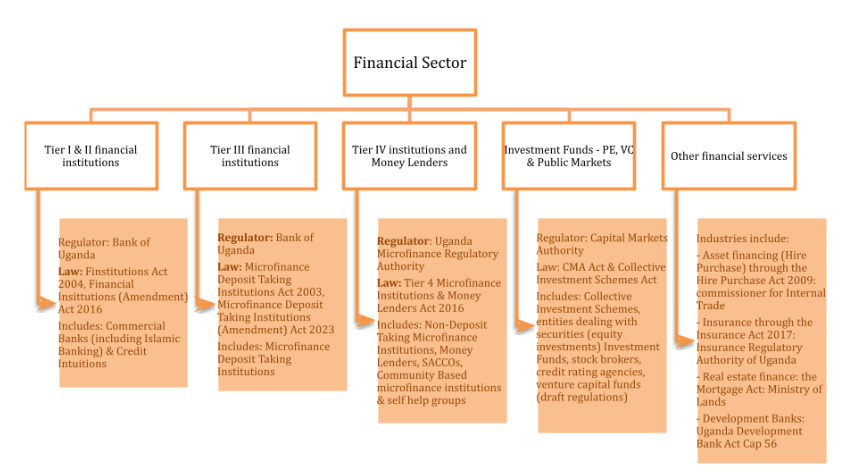

Uganda’s financial services sector at a glance

In Uganda the following entities and sectors are regulated to carry out financing activities:

- Tier I Financial Institutions: Commercial Banks (including Islamic Banking)

- Tier II Financial Institutions: Credit Institutions

- Tier III Financial Institutions: Microfinance Deposit Taking Institutions (MDIs)

- Tier IV Microfinance Institutions & Money Lenders: Non-Deposit Taking Microfinance Institutions, SACCOs, Self Help Groups, Community Based Microfinance Institutions & Money Lenders

- Investment Funds (trading in company shares/ securities on both the public and private market): Private Equity & Venture Capital Funds, Collective Investment Schemes (CIS)

- Other specialized sectors/ Industries: Insurance, Hire Purchase & Asset Finance, Real Estate/ Project Finance, Development Finance Institutions (DFIs)

The following diagram provides an overview of Uganda’s financial services sector, regulatory authorities and applicable laws.

This guide has been created by TASLAF Advocates to provide an overview of financial institu- tions, money lenders and capital markets while highlighting their legal framework, licensing and registration requirements, key characteristics and the regulators that govern them. We have categorized the financial institutions into the following sections;

SECTION A: Financial Institutions regulated by the Bank of Uganda

SECTION B: Financial Institutions regulated by the Uganda Microfinance Regulatory Authority

SECTION C: Financial Institutions regulated by the Capital Markets Authority

SECTION A

FINANCIAL INSTITUTONS REGULATED BY THE BANK OF UGANDA (BOU)

The Bank of Uganda (BOU) is the Central Bank of Uganda whose mandate is to regulate the issuing of legal tender, maintaining external reserves, promoting the stability of the currency and ensuring a sound financial structure conducive to ensure a balanced and sustained rate of growth of the economy.

The Institutions regulated by the BOU are classified under three broad categories1 ;

- Tier I Financial Institutions;

- Tier II Financial Institutions;

- Tier III Financial Institutions

Tier I Financial Institutions (Commercial Banks)

Tier I Financial Institutions constitute commercial banks. A commercial bank is a company licensed to carry on financial institution business in Uganda and whose principal business consists in acceptance of call, demand, savings and time deposits withdrawable by cheque or otherwise, in the capacity of a bank, provision of overdrafts and short to medium term loans; provision of foreign exchange, participation in inter-bank clearing systems and the provision and assumption of guarantees, bonds and other warranties on behalf of others.2

Licensing Requirements – For a commercial bank to be licensed by BOU:

- It should be constituted as a company (a company limited by shares);

- It should submit an application to the Bank of Uganda setting out the details if its shareholders, directors and attaching to the application its business and financial plans, board risk management policies, management policies, management operating procedures and any other information relating to its viability;

- It should have a minimum paid up capital of not less than six million currency points (One Hundred Twenty Billion – UGX 120,000,000,000) by 31st December 2022.3

The licensing checklist for commercial banks (Tier 1) can be found on the BOU website at: chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://bou.or.ug/bouwebsite/ bouwebsitecontent/acts/other_acts_regulations/Licensing-Requirements-checklist.pdf

Commercial banks in Uganda – There were previously 25 licensed commercial banks in Uganda. Some of the commercial banks include Stanbic bank, DFCU Bank, Centenary Bank. On 8th September 2023 BOU issued its first Islamic Banking License to Salaam Bank Uganda as a Tier

- In addition to these 3 broad categories, BOU also regulates Forex Bureaus, Money Remitters, Non-Bank Payment Service Providers and Payment System Operators, and Credit Reference Bureaus for purposes of this guide we have focused on the 3 broad categories of financial institutions.

- Section 3 of the Financial Institutions Act, 2004

- Section 3 of the Financial Institutions (Revision of Minimum Capital Requirements) instrument 2022.

I financial institution bringing the number of commercial banks licensed as Tier I financial institutions to 26. A list of commercial banks as at 31 March 2023 can be found on the BOU website using this link: https://www.bou.or.ug/bouwebsite/Supervision/supervisedinstitutions.html or on the Deposit Protection Fund website at https://dpf.or.ug/commercial-banks/.

Tier II Financial Institutions (credit institutions)

Tier II financial institutions constitute credit institutions. Credit Institutions are described as “non-bank” financial institutions that engage in the acceptance of call and time deposits repayable after a fixed period or after notice and deployment of such deposits wholly and partly by lending or any other means for the accounts and at the risk of the person accepting such deposits.

Licensing Requirements – For a credit institution to be licensed by the Bank of Uganda, the following requirements should be fulfilled:

- It should be constituted as a company (it may either be a private company limited by shares or by guarantee);

- It should submit an application to the Bank of Uganda setting out the details of its shareholders, directors and attaching to the application, its business and financial plans, board risk management policies, management policies, management operating procedures and any other information relating to its viability;

- It should have a minimum paid up capital of not less than one (1) million currency points (Twenty Billion – UGX 20,000,000,000) by 31st December 2022.4

Credit Institutions in Uganda – Uganda currently has 4 licensed credit institutions recognized by the Bank of Uganda as of 30 June 2022. These include BRAC Uganda Bank Ltd, Mercantile Credit Bank Limited, Yako Bank Bank Uganda Limited, and Top Finance Bank Limited. An updated list of the licensed credit institutions can be found on the BOU website using this link: https://www. bou.or.ug/bouwebsite/Supervision/supervisedinstitutions.html or on the Deposit Protection Fund website at https://dpf.or.ug/credit-institutions/.

Tier III Financial Institutions (Micro-Finance Deposit Taking Institutions – MDIs)

Tier III Financial Institutions constitute Microfinance Deposit Taking Institutions (MDIs).

MDIs are defined as “a company licensed to carry on, conduct, engage in or transact in microfinance business in Uganda.” The law further defines “microfinance business” to include:

- The acceptance of deposits from members of the public by any person or institution, regardless of the business form, whether licensed by the Central Bank or not;

- Employing such deposits, wholly or partly, by lending or extending credit for the account and at the risk of the person accepting those deposits, including the provision of short-term loans or other credit to small or micro enterprises and low-income households, usually characterized by the use of collateral substitutes, such as group guarantees or compulsory savings;

- Section 3 of the Financial Institutions (Revision of Minimum Capital Requirements) Instrument 2022

- Engaging in Islamic microfinance business;

- Transacting such other activities as may, be prescribed by the Central Bank.

Licensing Requirements – For a Micro Finance Deposit Taking Institution (MDI) to be licensed by the Bank of Uganda, the following requirements should be fulfilled:

- It should be constituted as a Company (it may either be a private company limited by shares or by guarantee).

- It should submit an application to the Bank of Uganda setting out the details of its shareholders, directors and attaching to the application, its business and financial plans, board risk management policies, management policies, management operating procedures and any other information relating to its viability.

- It should have a minimum paid up capital of not less than one million currency points (Twenty Billion – UGX 20,000,000,000) by 31st December 2022.5

MDIs in Uganda – Uganda currently has 3 licensed MDIs recognized by the Bank of Uganda as of 19 January 2024. That is FINCA Uganda Limited (MDI), PRIDE Microfinance Limited (MDI) and UGAFODE Microfinance Limited (MDI). An updated list of the licensed MDIs in Uganda can be found on the BOU website using this link: https://www.bou.or.ug/bouwebsite/Supervision/ supervisedinstitutions.html or on the Deposit Protection Fund website at https://dpf.or.ug/ microfinance-deposit-taking-institutionsmdis/

Legal Framework governing Tier I, II, III Financial Institutions in Uganda

Primary Legislation:

- The Financial Institutions Act, 2004;

- The Financial Institutions (Amendment Act), 2016;

- The Financial Institutions (Amendment) Act, 2023;

- The Micro-Finance Deposit Taking Institutions Act 2003;

- The Micro-Finance Deposit Taking Institutions Act (Amendment) Act 2023;

Secondary Legislation:

- The Financial Institutions Licensing Regulations 2005;

- The Microfinance Deposit Taking Regulations 2004;

- The Financial Institutions (Revision of Minimum Capital Requirements) Instrument 2022;

- The Financial Consumer Protection Guidelines 2011;

- The Financial Institutions Agent Banking Regulations 2017;

- The Financial Institutions (Islamic Banking) Regulations 2018;

- The Micro Finance Deposit-Taking Institutions (Amendment of Second Schedule) Instrument, 2022;

- The Financial Institutions (Amendment of Third Schedule) Instrument, 2022;

- The BOU Consolidated Corporate Governance Guidelines, October 2022;

- Section 3 of the Financial Institutions (Revision of Minimum Capital Requirements) Instrument 2022

- The BOU Risk Assessment Guidelines for Supervised Financial Institutions (SFIs), December 2022;

- The Financial Institutions (Revision of Minimum Capital Requirements) Instrument, 2022;

- The Micro Finance Deposit Taking Institutions (Registered Societies) Regulations, 2023;

- The Financial Institutions (Liquidity) Regulations, 2023.

All laws, regulations, and policies can be found on the BOU website by following this link: https://www.bou.or.ug/bouwebsite/Supervision/supervisedinstitutions.html

Summary Table for Tier I, II, S III Financial Institutions

Financial Minimum Capital Authorized Activities Structuring Institutions Requirements 6(UGX) | |||

Tier I (Commercial Banks) | UGX. 120,000, 000,000 |

| Company limited by shares |

Tier II (Credit Institutions) | UGX. 20,000,000,000 |

| Private company which may be limited by shares or limited by guarantee |

Tier III (Micro Finance Deposit Taking Institutions – MDIs) | UGX 20,000,000,000 |

| Private company which may be limited by shares or limited by guarantee |

- As at November 2023 based on the Financial Institutions (Revision of Minimum Capital Requirements) Instrument 2022

SECTION B

INSTITUTIONS REGULATED BY THE UGANDA MICROF- INANCE REGULATORY AUTHORITY

The Uganda Microfinance Regulatory Authority (UMRA) is a government regulatory agency established by the Tier IV Microfinance and Money Lenders Act 2016.

The mandate of UMRA is to promote a sound and sustainable non-banking financial institutions’ sector, to enhance financial inclusion, financial stability, and financial consumer protection among the lower income population in Uganda.

The non-banking financial institutions sector in Uganda consists of;

- Tier IV Microfinance institutions

- Money lenders.

Tier IV Micro Finance Institutions

The Tier 4 Microfinance institutions comprise of:

- Non-Deposit Taking Microfinance Institutions (NDTMIs);

- Savings and Credit Cooperative Associations (SACCOS);

- Self –Help groups;

- Commodity based Microfinance Institutions

Non-Deposit Taking Microfinance Institutions (NDTMI)

A Non-Deposit Taking Microfinance Institution (NDTMI) is a company or a non-governmental organization licensed by UMRA which participates in microfinance activities and assists in the development of micro, small and medium sized businesses as well as expanding access to micro loan resources to individuals for the promotion of their businesses, livelihoods, and land holdings.

Licensing Requirements – For a NDTMI to be licensed by UMRA it must fulfill the following requirements:

- Be constituted as a company or an NGO.

- Submit an application to UMRA which must be accompanied by; (i) a certificate of incorporation for a company issued by URSB or a certificate of registration for a non- governmental organization issued by the NGO Bureau; (ii) the MEMARTS of the company or Constitution of the NGO or other incorporation documents; (iii) the company or NGO’s management structure; and (iv) evidence of payment of the prescribed fees (UGX 50,000);

- Minimum capital requirements for NDTMI have not yet been prescribed by UMRA through it has the mandate to do so under the Act.

- The license is renewed annually at UGX 500,000.

Savings and Credit Cooperative Associations – SACCOS

A SACCO is a voluntary society of association where by members regularly pool their savings, and may subsequently use the funds for various purposes which may include but are not limited to, making credit available to the members,

The law prohibits a SACCO from carrying on the business of financial services without a license issued by UMRA.

Licensing Requirements – For a SACCO to be licensed by UMRA, the application for licensing should be accompanied by the following:

- A certified copy of the certificate of registration of the SACCO issued under the Cooperative Societies Act;

- Evidence that the SACCO meets the minimum equity requirements as prescribed by the authority;7

- Information on the prospective place of business, indicating the head office and branches;

- Evidence of payment of the prescribed fees;

- A statement on the objectives of the registered society in relation to offering financial services;

- Evidence of the membership and the shareholding of the members;

- A statement on the economic and financial environment of the registered society;

- The organizational structure and management of the registered society;

- The business plan of the registered society; and

- The credit policies and lending procedures of the registered society.8

Self-Help Groups

A Self-help group by nature carries out the following activities:

- Mobilizes and manages its own savings;

- Provides interest bearing loans to its members;

- Offers a limited form of insurance to its members;

- Shares out member equity at once a year in proportion to the savings;

- It ought to be time bound.9

The law requires a self-help group to be registered for the purpose of developing the economic interests of the group members. The process for registration of self help groups is carried out by the “responsible officer” in a district – this is the Community Development Officer.

Commodity-Based Microfinance

A commodity-based microfinance means the provision of microfinance services in the form of goods and services.10 Under the law the recipient of a commodity shall not use that commodity for a purpose other than income generation. A commodity is defined under the law as any article,

- Section 47 of the Tier 4 Microfinance Institutions and Money Lenders Act 2016

- Section 38 (2) of the Tier 4 Microfinance Institutions and Money Lenders Act 2016; Regulation 3 Tier 4 Microfinance and Money Lenders (SACCO) Regulations, 2020

- Section 99 (1) of the Tier 4 Microfinance Institutions and Money Lenders Act 2016

- Section 102 of the Tier 4 Microfinance Institutions and Money Lenders Act 2016

product or thing which is or will ultimately be the subject of trade or use.11

A recipient is defined as a person who is selected to receive a commodity. Under the law12 persons who receive commodities cannot liquidate the commodity acquired or assign or transfer the commodity without the approval of the Authority.

Money Lenders

A money lender is defined as a company licensed to carry out money lending business. The money lending business is one of the facets of the financial services sector in Uganda.

Money lenders in Uganda are regulated and licensed by the Uganda Microfinance Regulatory Authority (UMRA)

Licensing Requirements – For a Money Lender to be licensed by UMRA it must:

- Be constituted as a Company;

- Submit an application to UMRA which must be accompanied by; (i) a certificate of incorporation; (ii) forms of particulars of directors and secretary; (iii) particulars of the address; (iv) copies of national identity cards for directors and the secretary; and (v) evidence of payment of the prescribed fees (UGX 50,000);

- Minimum capital requirements for Money Lenders have not yet been prescribed by UMRA through it has the mandate to do so under the Act;

- The license is renewed annually at UGX 500,000. Key aspects to note about the money lending business

- Money lenders are prohibited from applying compound interest.13

- They are also prohibited from charging expenses on loans on account of costs, charges, or expenses incidental to or relating to the negotiations for granting of the loan.14

- No maximum interest rate has been prescribed by the Ministry of Finance or UMRA for money lender.

- A note on debt structuring for foreign lenders: although most Ugandan domiciled debt funds do not want to register as money lenders, it is a requirement unless they meet the specifications for a NDTMI, we shall now address the distinction between NDTMIs and Money Lenders under Ugandan law.

Distinction between NDTMIs and Money Lenders

- Restrictions on the amount of money that can be loaned

NDTMIs are restricted to issuing only micro loans these are amounts not exceeding a) 1% of their core capital for an individual borrower or b) 5% for a group borrower whereas there are no restrictions on the amount of money a money lender can lend out or to whom.

- Section 1(e) of the Uganda National Bureau of Standards Act Cap 327

- Section 104 of the Tier 4 Microfinance Institution and Money Lenders Act 2016

- Section 86 of the Tier 4 Tier 4 Microfinance Institutions and Money Lenders Act 2016

- Section 96 of the Tier 4 Microfinance Institutions and Money Lenders Act 2016

- Structuring

NTMIs may be constituted as either a private company or an NGO, whereas a money lender must strictly be registered as a company limited by shares (even if the money lender consists of a single individual person lending money).

A note on lending through digital platforms

In February 2024, the Minister of Finance in charge of Microfinance issued a directive banning UMRA’s issuance of licenses to digital lending platforms categorized as online money lenders in Uganda.

Following the Minister’s directive UMRA published the Tier 4 Digital Lending Guidelines (available on UMRA’s website: https://umra.go.ug/digital-lending-guidelines/) to regulate internet-based lending apps.

The guidelines state that they apply to an institution or a money lender providing credit using digital channels and licensed under the Tier 4 Microfinance Institutions and Money Lenders Act, 2016.

The overall objective of these guidelines is to streamline the operations of digital lenders to safeguard consumers against predatory lenders. The key things to note about the guidelines are:

- Digital credit providers are forbidden from collecting deposits in any form from their customers.

- Everyone carrying out digital credit business in Uganda must obtain a license from UMRA.

- Those who have been carrying out digital credit business without a license are required to apply for one with UMRA within 3 months of the publication of the guidelines.

- The requirements for and process of procuring a license is similar to that of regular (non-digital) Teir 4 Microfinance Institutions & Money Lenders except for the following additional information which must be provided in the application;

- Description of the information and communication technology system to be used in the operations of the digital credit provider;

- Description of delivery channels or platforms to be deployed by the digital credit provider;

- Description of, and terms and conditions of credit products and services which the proposed digital credit provider intends to provide;

- Agreement with a telecommunication or other service provider for provision of channel or platform for the provision of digital credit.

- The proposed digital credit provider’s Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) policies and procedures;

- The proposed digital credit provider’s data protection policies and procedures;

- Description and evidence of sources of funds to be invested in the digital credit provider;

- Credit policy, code of ethics and market conduct;

- The proposed digital credit provider’s pricing model and parameters;

- Corporate governance policy;

- A certificate issued pursuant to Data Protection Act,2019;

- Any other information as may be required by the Authority.

Legal Framework governing Tier 4 Microfinance Institutions and Money Lenders in Uganda

Law | Summary of the Law |

The Tier 4 Microfinance Institutions and Money Lenders Act, 2016 | This Act generally provides for:

|

The Tier 4 Microfinance and Money Lenders (Non- Deposit Taking Microfinance Institutions) Regulations, 2018 | These Regulations specifically govern NDTMIs and they provide for:

|

The Tier 4 Microfinance and Money Lenders (SACCO) Regulations, 2020 | These Regulations specifically govern SACCOS and they provide for:

|

The Tier 4 Microfinance Institutions and Money Lenders (Money Lenders) Regulations, 2018 | These Regulations specifically govern money lenders and they provide for:

| |||

Digital Lending Guidelines for Tier 4 Microfinance Institutions and Money Lenders (2024) | These guidelines specifically govern Tier 4 Microfinance institutions and Money Lenders providing credit using digital channels and they provide for:

| |||

A note on Islamic Microfinance

The law provides for Islamic microfinance15 as a service a tier 4 microfinance institution may offer in addition to or alongside it’s usual financial services.

Under the law before a tier 4 microfinance institution can operate Islamic microfinance it must apply to UMRA for approval. This application has to be accompanied with the following;

- Proof that the proposed dealings and transactions in Islamic microfinance will be in accordance with Shari’ah;

- a nominee to be appointed as a Shari’ah advisor;

- the modes of finance and product structures proposed to be used for raising resources and extending financial assistance to clients;

- a Shari’ah compliance mechanism;

- a method of segregating Islamic microfinance business from the conventional microfinance business;

(d) any other information the authority may require.

- Under part VIII of the Tier IV Microfinance Institutions and Money Lenders Act 2016

SECTION C

INSTITUTIONS AND ACTIVITIES REGULATED BY THE CAPITAL MARKETS AUTHORITY OF UGANDA (CMA)

Capital markets deal in the trade of long-term financial products issued by Governments, private, and public companies. These products in Uganda include shares, bonds, commercial paper, and collective investment schemes which are generally referred to as securities and can be traded publicly the Uganda Securities Exchange (USE).

The capital markets industry in Uganda is regulated by the Capital Markets Authority of Uganda (CMA) which is a semi-autonomous government body established by the Capital Markets Authority Act, Cap 84, with a primary responsibility of promoting and facilitating the development of an orderly, fair, and efficient capital markets industry in Uganda.

In fulfilling its mandate, the CMA;

- Approves the securities exchange,

- Licenses various market players such as broker/ dealers, investment advisors, and collective investment scheme managers,

- Approves all offers of securities to the public. The CMA regulates the activities of:

- Uganda Securities Exchange (USE);

- Licensed intermediaries such as brokers/dealers;

- Investment & transaction advisors;

- Venture Capital Funds;

- Fund managers;

- Collective Investment Schemes;

- Market advisors;

- Other persons listed under Section 30 of the Capital Markets Authority Act.

Licensing Requirements – For an entity or individual to act in any of the above listed capacities, they ought to have procured the approval of the CMA and a license to operate from the CMA. The following requirements ought to be fulfilled for a license to be issued by the CMA;

- The applicant ought to furnish a detailed statement of their assets and liabilities signed by the applicant;

- In the case of an applicant which is a company, the application should be accompanied by: copies certified by a director of the company to be true copies of the last balance sheet and of the last profit and loss account, if any, incorporating the results of the last financial year, and which have been audited by the company’s auditors; as well as a certified copy of the report of the auditors;

- A detailed statement of the financial resources available to the applicant to undertake the business under the license;

- Proof of payment of the requisite fees depending of the license being applied for;

- Any other information which the authority may require in consideration of the application.16

Firms licensed by CMA; The list of approved persons can be found at https://cmauganda.co.ug/ supervision/licensing-approvals/licensed-firms/. Currently, the CMA has approved 2 stock exchanges, licensed 2 securities central depositories, 8 brokers, 2 dealers, 7 fund managers,

5 collective investment scheme managers, 2 trustees, 7 investment advisors and 17 listed companies (these numbers and figures are subject to change).

General Legal Framework governing Capital Markets in Uganda

Law Summary of the Law | |

| The Act generally provides for:

|

| The Regulations generally provide for the following;

|

The Collective Investment Schemes Act, 2003 | This Act provides for the general control and licensing of collective investment schemes. |

The Securities Central Depository Act, 2009 | This Act generally provides for:

|

All laws, regulations, and policies can be found on the CMA website by following this link: https://cmauganda.co.ug/regulation/laws/

- Regulation 5 of the Capital Markets Authority (Licensing) Regulations, S.I 84-1

Disclaimer:

The information provided in this user’s Guide does not, and is not intended to, constitute legal advice. Instead, all information, content, and materials contained in this Guide are for general informational purposes only.

Information in this Guide may not constitute the most up-to-date legal or other information. This guide contains links to other third-party websites and resources. Such links are only for the convenience of the reader, user or browser, TASLAF, its lawyers and its affiliates do not recommend or endorse the contents of the third-party sites.

TASLAF advises readers and users of this Guide to contact their own qualified lawyers and obtain advise with respect to any particular legal matter. No reader or user of this Guide should act or refrain from acting on the basis of the information provided in this Guide without first seeking legal advise from qualified counsel.