Working in Uganda’s Oil & Gas Sector : Key Requirements for Expatriate Work Permits

Foreign workers are required under Section 53 of the Uganda Citizenship and Immigration Control Act and Regulation 21 of the Petroleum (Exploration, Development and Production) (National Content) Regulations to obtain work permits prior to taking up employment in Uganda. Work permit applications are approved and issued by the Directorate for Citizenship and Immigration Control under the Ministry of Internal Affairs.

Legal Alert on Filing Annual Returns

Filing annual returns for a company with the company registrar is mandatory as encapsulated in Section 132 of the Companies Act 2012. It provides that every company which has a share capital must file annual returns with the registrar.

Annual returns show the changes that have occurred within the company during the year such as change of shareholding, directorship and the registered office of the company.

The TASLAF Probono Support Facility for the Creative Arts

TASLAF Advocates is a leading law firm in Uganda that provides blended legal and tax services to enterprises in Uganda. Our clients include the leading Impact Finance and Private Equity Funds, social enterprises, construction & manufacturing firms, Agricultural enterprises and the leading non-profit/NGO’s operating or looking to expand in East Africa. We are driven by a desire to create social impact and influence Africa’s entrepreneurial and social ecosystem through legal support.

Filing the FIA Annual Compliance Report

Every accountable person is required by Regulation 45(1) of the Anti-Money Laundering Regulations, 2015 to submit to the Financial Intelligence Authority(FIA) a compliance report setting out the level of compliance with the Act and Regulations and the Internal Anti-Money Laundering and Combating Terrorist Financing Policy of the accountable person at the end of each calendar year. The FIA developed a compliance report template to streamline and standardise the reports submitted by Accountable persons.

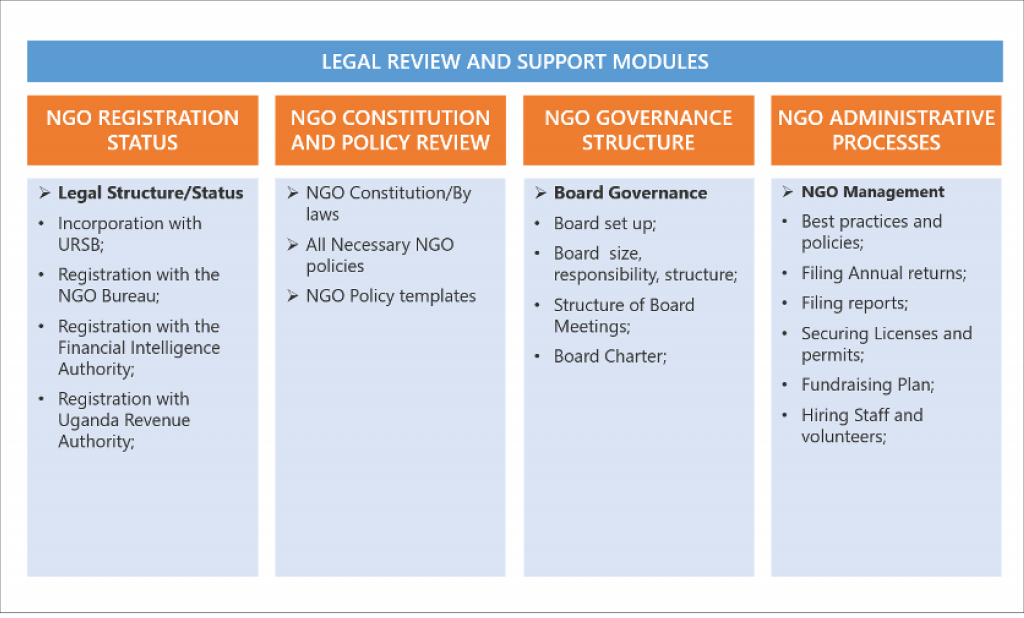

TASLAF NGO Legal & Administrative Compliance Audit Program

The recent 2016 NGO Act provides a new legal and regulatory framework that introduces dynamic changes in the registration, licensing, regulation and governance of Non-Governmental Organisations (NGOs) in Uganda. The new law creates a mandatory requirement on all NGOs to comply with these rules and regulations governing their operations within the country.

Annual General Meetings and Director’s Meetings During the COVID-19 Lockdown in Uganda

The Ugandan Government has announced a number of measures in an attempt to contain the spread of the novel coronavirus (COVID-19). Measures aimed at social distancing are creating a host of issues and implications for the corporate governance of companies and organisations. As associations enter into the Annual General Meeting (AGM) season, many are considering changing the format of their AGM from an in-person meeting to a virtual-only or hybrid meeting.

Legal Alert – Employment & Tax Considerations

Regular employment law applies to all employment relationships – regardless of the disruptions at various workplaces as a result of COVID-19 pandemic. This includes anything that has been agreed to in an employment agreement.

Covid-19 and the Immigration Policy in Uganda

The spread of the new coronavirus-COVID-19, has caused panic across the World. With the number of confirmed cases on the rise in Uganda, the coronavirus has affected several facets of immigration and movement of persons.

Covid-19: Key Legal Issues for the NGO/Non-Profit Sector in Uganda

In just a few weeks, 30 African countries have reported cases of COVID-19 Virus, the latest being Tanzania and Somalia which have reported their first cases of corona-virus at the time of this writing. In response, many countries have shut down schools, churches, businesses and banned concerts and gatherings. There are now 19 confirmed cases of COVID-19 across the six countries in East Africa.